International Trading Business Unit operates fully-integrated international business to enhance national energy security in parallel with the expansion of the trading base to all regions of the world. The business unit covers procurement, import, export and international trade in several products including: crude oil, condensate, LPG, petroleum and petrochemical products, chemical solvents, crude palm oil, refined palm oil, palm kernel shells and other commodities. The business units also in charge of price risk management and international chartering in order to achieve our target to become the leading multinational trading company, enhance energy security for the Kingdom, and strive for Thai pride in the international trade arena.

The business unit has appointed subsidiaries and representative offices in commercial hubs around the world including Singapore, Dubai; United Arab Emirates, Shanghai; China, Jakarta; Indonesia, and London; UK. Today, the business unit is managing business transactions around the world. Since international trading transactions are high in value, they need an effective risk control system under the best practices adopted by leading international trading houses. Meanwhile, we also utilize information technology system for transactions to enable quick, transparent, and efficient control.

Ensuring energy security for Thailand, International Trading Business Unit fulfills the role in securing crude oil and condensate to serve demand of domestic refineries from both local fields and extensive international productions with barrel, price and quality in line with country energy consumption.

Aside from creating sustainable energy security of Thailand, we have continuously developed worldwide trading expansion to strengthen crude oil and condensate trading base in international market and create ripples of value-added return back to the country. With many years of trading expertise and operational excellence, we are among major regional players of crude oil and condensate with far-reaching trading network and business alliances around the globe including Middle East, Asia Pacific, Africa, Europe and America.

In dealing with the excess country’s demand and the surplus of domestic refineries’ production, International Trading Business Unit conducts a procurement, importing and exporting along with market price index of all refined petroleum products, specialty products, NGL and LPG in order to ensure the security and stability of country’s energy. On the other hand, we strive to create more trading value with fully trading activities, which cover storing, managing, blending and delivering products to our customers in regional and global destination.

International Trading Business Unit focuses on balancing supply and demand of petrochemical products from domestic petrochemical plants, covering from upstream to intermediate products in aromatics and olefins chains. The business unit is also responsible for procuring and trading of petrochemical feedstock, by-products, petrochemical products as well as chemicals and solvents. Moreover, the business unit also focuses on expanding to secure supply base from major petrochemical producer in South Asia and Middle East to enhance security of petrochemical supply for Thailand petrochemical industry along with expanding international footprint to all regions such as Asia, Europe and America in order to create additional value internationally.

Align with global mega trends toward cleaner & green commodities, International Trading Business Unit has geared beyond oil trading portfolio to non-oil related commodities providing wide range of trading commodities e.g. crude palm oil for bio-diesel production; refined palm oil for food industry; palm kernel shell as a green feedstock for industry and power plants; non-ferrous metals for electricity value chain and battery storage; and LNG trading which serves as main feedstock for power generation in the future.

Economic instability, political turmoil and the volatility of supply and demand have caused wild fluctuations in the price of oil. Oil price volatility impacts the revenue and cost of the petroleum and petrochemical supply chain. Through knowledge of the variables of oil price is crucial, we are closely monitoring the oil market situation of oil’s price movements by regions. A prudent use of future market mechanism is also instrumental to PTT’s function to provide the government and companies with valuable information on global oil market outlook in order to achieve business goals. In addition, we provide risk management service to other companies in other industry such as aviation and industrial sectors. Participation in the future market with detailed analysis allows us an appropriate selection of price risk management tools.

International Trading Business Unit provides services for the transportation of various products in both domestic and international waters. The business unit also provides spot and time-chartered vessel services for PTT group companies and trading partners both domestic and overseas with internationally-recognized standards and economically competitive charges

Additionally, the business unit also effectively manage chartering services to overseas customers in order to support growing physical commodity trading

International Trading Business Unit manages trading transactions and activities globally, involving complex and high-value transactions, and also expose to counterparty risk and commodity price risk. An effective trading risk control system is an essential, we had adopted the best practices of leading trading house to balance flexibility under minimized risks and transparency of trading activities.

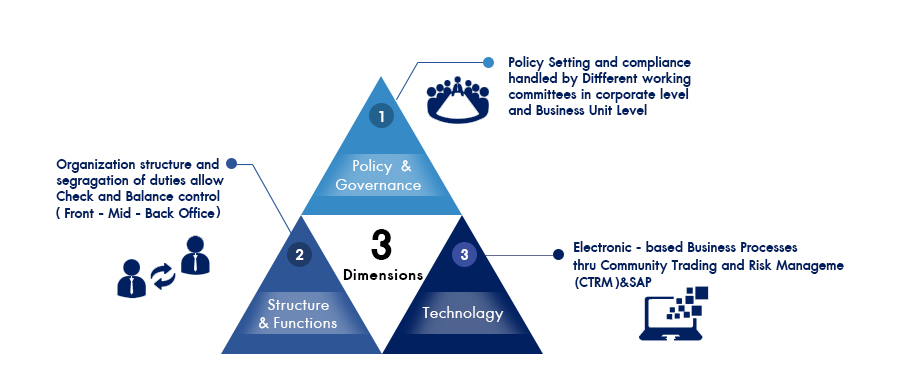

Trading activities are controlled by means of three aspects:

By policy, through a committee on trade framework, credit extension and business risk management and by using good corporate governance as a guideline for business conduct for management and staff.

By structure and duty, through a control and cross-check system under the company's policy and regulations. The division of job functions are front office (liaising with clients), mid office (regulates trading and risk management) and back office (contracts and credit management).

By IT system, Commodity Trading Risk Management (CTRM) examines and regulates trading and risk management electronically on the on-line real-time basis. The system allows us to observe any transactions being carried out instantly and or taking any action needed under the company's regulations and organization structure.

International trading business unit has set up subsidiary companies and representative offices in the strategic location known as Global Trading Hub. The objective is to be the spearheads for international trading expansion path in dealing with storing, managing, blending and trading activities. The activities cover in various physical products including crude oil, Liquified natural gas (LNG), petroleum products, petrochemical products, renewable energy and general merchandise with international chartering and price risk management in order to maximize value-added to our customers. Our international offices liaise with our suppliers, customers and partners to enlarge the trading network internationally, enhancing energy security for our country and supporting commercial activities of PTT Group.

We currently has four subsidiary companies and one representative office,

- PTT International Trading Pte Ltd (PTTT), located in Singapore

- PTT International Trading London Ltd (PTTT LDN), located in London, England

- PTT International Trading USA Inc. (PTTT USA), located in Houston, the United States of America

- PTT MEA LTD (PTT MEA), located in Abu Dhabi, the United Arab Emirate

- Shanghai Representatives Office, located in Shanghai, the People's Republic of China