Tax Transparency

Our Mission

Being a publicly listed state-owned enterprise (SOE) serving as the national energy company of Thailand, PTT has a mission to conduct integrated energy and related business as a National Energy Company, while delivering values to all stakeholders with balanced and sustainable approach. In this endeavor, PTT strives to keep in view the rights and interests of all stakeholders, including the country, governments, societies, communities, investors, employees, customers, and business partners. PTT has been pursuing all its businesses while promoting national sustainable development, striving for not only economic returns, but also the highest attention to societies, communities and the environment. This multi-stakeholder approach has enabled PTT to reach a higher level of transparency and sustainability.

Our Values

PTT is committed to be an organization that generates economic growth, enhancing Thailand’s competitiveness to develop society and people’s well-being. With innovations and technology, we are the driving force in transitioning people, society, communities and environment forward, in line with our vision of “TOGETHER FOR SUSTAINABLE THAILAND, SUSTAINABLE WORLD”. We promote the organizational values of SPIRIT: S for Synergy; P for Performance Excellence; I for Innovation, R for Responsibility for Society, I for Integrity & Ethics, T for Trust & Respect. The vital elements of Integrity and Ethics encompass transparency, compliance and good governance, which are maintained in every aspect of our operations across PTT Group and in all the countries where we operate.

Moreover, we are committed to the United Nations Global Compact core values on human rights, labor standards, the environment, and anti-corruption, and supportive of the Extractive Industries Transparency Initiative (EITI) principles. The EITI provides a global standard to promote open and accountable management, thereby elevating the sustainability and transparency standards for extractive industries to respond to all stakeholders.

Tax Strategy for SustainabilityGRI 207-1, GRI 207-2

With its endeavor to be a model organization for sustainability and operational excellence based on good governance, PTT has maintained its status as a member of Dow Jones Best-in-Class World Index (old name is DJSI World), of which it was the first Thai company to join in 2012, among global oil and gas producers (Oil & Gas Upstream & Integrated: OGX).

The Dow Jones Best-in-Class Indices (DJBICI) assessment criteria focus on the success and efficiency of business operations, particularly regarding contributions to economic growth, and social and environmental development. One key criterion is the Tax Strategy. The DJBICI’s Tax Strategy assessment focuses on the public disclosure of tax policy, the transparency on revenue, operating profit and tax reporting, and the management of tax risks. Being assessed by the Dow Jones Best-in-Class Indices (old name is DJSI) since 2014 until present, PTT has repeatedly achieved the full score and the Industry Best for numerous years, which is significantly above the industry average and Dow Jones Best-in-Class World Index (old name is DJSI World) average.

PTT Group’s taxes paid globally demonstrate our significant contributions to public finances in the countries where we operate. The voluntary disclosure in DJBICI shows our intention to maintain transparency on our payments to governments and is consistent with PTT’s support for the EITI principles. As part of our corporate commitment to sustainable development and good governance, PTT is committed to providing transparency about tax payments made to governments, and continuing an ongoing leadership in developing best practices in tax transparency.

Furthermore, PTT’s dedication to sustainable development and good corporate governance has led to the establishment of channels for employees or external parties to report concerns or violations of laws and organizational regulations (Whistleblowing). This is in accordance with the principles of good corporate governance and PTT’s business philosophy, reinforcing its commitment to transparency in tax practices. PTT will continue to lead the way in developing and promoting best practices for tax transparency.

Global Tax Reform and Fair Effective Tax system

Globalization and digitalization have impacted all business operators’ ways of conducting business. Traditional tax concepts are being challenged as they may not be applicable when there is no physical presence of a company in a jurisdiction(s) where revenue is generated. Double non-taxation has been a concern of the OECD and governments with jurisdictions offering low tax rates and tax incentives to promote investments in those jurisdictions. These low-tax and no-tax policies can lead to the implementation of aggressive tax optimization strategies to minimize a multinational enterprise’s global effective tax rate. The OECD has developed frameworks to address the challenges of double non-taxation and de facto unfair tax systems, and has been prepared frameworks on Base Erosion and Profit Shifting (BEPS) 2.0 Pillar One and Pillar Two.

Although the financial results for 2024 should be the first year that PTT will have a Pillar Two reporting obligation to tax authorities, since 2021, PTT has been closely monitoring the OECD’s guidance, legislative developments in countries where PTT operates, and has been enhancing internal systems and procedures for reporting accurate and timely information to the relevant authorities when statutory reporting comes into effect, in its commitment of collaborating with the international community for a sustainable, fair and effective tax system across all jurisdictions.

PTT Group Tax Policy and Governance Framework

Our tax policy

In support of its overall business strategy and values, PTT pursues a tax policy that is principled, transparent and sustainable in the long run. Our tax policy is underpinned by our core values, “SPIRIT”, particularly Responsibility for Society, Integrity and Ethics, and Trust and Respect. These principles are embedded at all levels of our organization and is deployed under the “PTT Group Way of Conduct” ensuring alignment in tax strategies among all PTT Group companies, and promoting good governance and sustainability.

Since 2014, the “PTT Group Way of Conduct” has been implemented across PTT Group. Among the twenty policies in the PTT Group Way of Conduct, our tax policy is categorized as a compulsory policy that must be announced and followed by PTT Group. The tax policy sets out the principles that define how PTT Group manages its tax affairs, and aims to reinforce global alignment on tax corporate governance matters. Essentially, we are committed to conducting our business in compliance with the spirit of relevant rules, laws and regulations, as well as the letter of law of the tax laws and regulations applicable to PTT Group, in all areas where we operate, domestically and internationally. We strongly believe in paying our fair share of taxes. We trust that taxes have a substantial impact on our long-term corporate value and that implementing the tax policy is the initial step towards greater transparency and good governance.

We believe our tax policy elucidates our good governance in the area of tax management and tax transparency, balancing the interests of our various stakeholders in the countries where we operate. Our tax policy reflects not only the tax affairs and practices implemented by PTT personnel, but also the values upheld by PTT Management who are actively involved in the development and approval process of our tax policy.

We have further reinforced our tax policy across PTT Group by implementing the PTT Group Tax Policy Guidelines. Both Tax Policy and PTT Group Tax Policy Guidelines, approved by the CEO, who is also a member and representative of the Board of Directors, will be reviewed annually along with the PTT Group Way of Conduct in order to be embedded into the way we do our business, ensuring our full compliance with the six key tax areas: Tax compliance, Tax Advisory & Planning, Transfer Pricing, Tax Audit, Tax Risk Management and External Tax Advisor.

PTT Group's Tax Risk Management FrameworkGRI 207-2

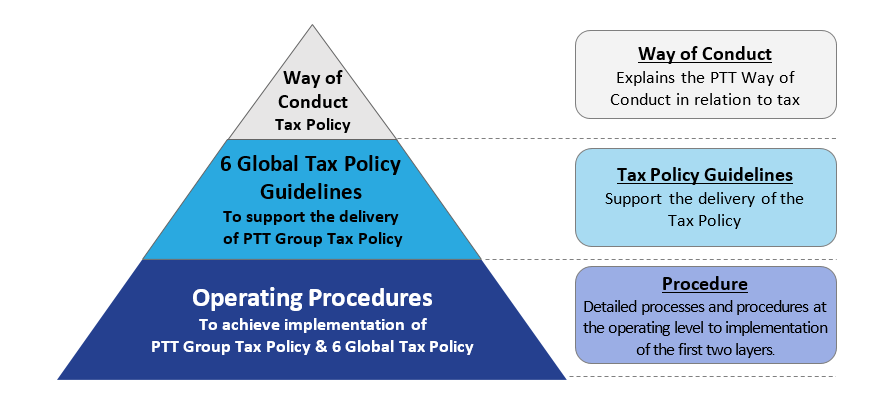

PTT Group Tax Risk Management Framework comprises of three layers:

1. The top layer, “PTT Group Way of Conduct – Tax Policy,” establishes the principles that define how PTT Group manages its tax affairs.

2. The middle layer, “Global Tax Policy Guidelines,” serves as the policy guideline level to support the delivery and implementation of the Tax Policy. This layer provides guidelines on how tax risks are managed across the identified tax activity areas. The Global Tax Policy Guidelines consist of

- Tax Compliance

- Tax Advisory and Planning

- Transfer Pricing

- Tax Audit

- Tax Risk Management

- External Tax Advisor

3. The bottom layer, “Operating Procedures,” contains the detailed processes and procedures at the operating level to implementation of the first two layers. They are internal processes created and executed by each PTT Group affiliate. Operating Procedures do not necessary to be identical from one affiliate to another, but they must be in accordance with Tax Policy and Global Tax Policy Guidelines.

Tax Risk Management Framework

The Six Global Tax Policy Guidelines to support the delivery of the Tax Policy deal with the following tax areas:

- Tax Compliance - Sets out the guidelines ensuring that PTT Group is complying with its tax filing obligations in a timely and accurate manner. Diligent professional care and judgment, including ensuring that all tax risks and tax compliance, are taken at an appropriate level and supported by documentation.

- Tax Advisory and Planning - Sets out the guidelines ensuring that new transactions, mergers, acquisitions, divestments and etc. are reviewed in a consistent manner to ensure that tax planning is aligned with business and commercial strategies and the tax risks are identified, assessed, reported and managed.

- Transfer Pricing - Sets out the guidelines ensuring that all related-party transactions are conducted at arm’s length terms, and the transfer pricing documentation required to support the transfer pricing methods applied are properly prepared and retained.

- Tax Audit - Sets out the guidelines ensuring that all tax audits and relationships with tax authorities are managed consistently, demonstrating PTT Group’s commitment to engage in an open, mutually respectful and professional manner, enabling an efficient and collaborative hearing and resolution of PTT Group’s tax issues.

- Tax Risk Management - Sets out the guidelines ensuring that all personnel with tax responsibilities, or whose business activities may have a tax impact, have a consistent understanding of how tax risk is identified, assessed, reported, and managed.

- External Tax Advisor - Sets out the guidelines on the engagement of external tax advisors, only when required, ensuring that the external tax advice obtained is of a consistently high standard.

Tax Structuring ApproachGRI 207-1

PTT Group realizes that profits should be taxed where the economic activities generating the profits are performed, and expects to pay its fair share taxes on our activities where they take place, and thus disallow the transfer of value created to low/no tax jurisdictions. We are fully aware of direct and indirect risks from aggressive tax planning and do not use contrived or abnormal tax structures that are intended for tax avoidance and have no commercial substance. PTT’s Management and Board of Directors do not support any activities aiming to aggressively structure PTT Group’s tax affairs.In structuring our operations, we consider a wide range of factors and their consequences to balance the commercial, cost (including tax), regulatory, and investors’ perspectives. BEPS 2.0 Pillar Two Global Minimum Tax, as well as to ensure that we comply with all necessary obligations applicable to our unique status – a publicly-listed company, a national energy company, and an SOE.

In the past, locations of our foreign subsidiaries were mainly driven by commercial reasons, in particular, convenience and flexibility of such locations. In the recent years, however, our key considerations have shifted towards reputation and other non-financial risks. PTT has stipulated across PTT Group to avoid setting up our offshore subsidiaries in tax havens for tax avoidance purpose. The jurisdictions of PTT Group’s foreign affiliates are disclosed to all relevant tax authorities in our annual reports and have been regularly reviewed by our group to ensure compliance with all tax requirements and other regulations.

Co-operative Tax Reporting

A growing number of tax regulatory frameworks demands greater transparency, particularly in the areas of transfer pricing and substance requirements. As the ultimate parent company, PTT has been vigorously encouraging all group companies to strive for the highest level of transparency and governance in managing their tax affairs and raising greater awareness of direct and indirect risks associated with tax across the group.

Since 2015, PTT Group has proactively prepared for the three-tiered transfer pricing documentation requirements – Master File, Local File and Country-by-Country Report. These are new reporting standards and reporting rules initiated under the OECD/G20’s Base Erosion and Profit Shifting Project (BEPS) 1.0 plan, and provide tax authorities with information of PTT Group’s global allocation of profits, economic activities and taxes. By readily fulfilling these tax reporting requirements, our tax transparency has been uplifted to a global level.

Since 2021, PTT has been closely monitoring and preparing to fulfill tax compliance obligations as presented in the OECD’s BEPS 2.0 Pillar One and Pillar Two initiatives. In May 2023, the International Accounting Standards Board (IASB) introduced the International Tax Reform - Pillar Two Model Rules (IAS 12) that broadly requires a multinational company to disclose information and exposures related to OECD BEPS 2.0 Pillar Two (e.g., current tax expense, deferred tax assets and liabilities, exposure to income taxes, etc.) for annual reporting periods beginning on or after 1 January 2023. This requirement will significantly foster group-wide’s readiness and tax transparency for PTT as the ultimate parent entity, as well as our affiliates being constituent entities in the jurisdictions where PTT Group operates.

Revenue Transparency 2024GRI207-4

Our Broader ContributionGRI 207-3

PTT Group recognizes that the taxation of our income and profits, and activities in the jurisdictions where we operate, helps to fund the infrastructure and welfare support systems of those communities. Nevertheless, tax payments are one element of our broader economic and social contributions. The contributions that we make to the communities in which we operate extend beyond the taxes and other payments made to those governments. Our voluntary economic and social contributions are done in various means.

In addition to numerous Corporate Social Responsibility (CSR) projects carried out every year, PTT has introduced Creating Shared Value (CSV) on top of the business philosophy toward society, communities and the environment. PTT places strong emphasis on the in-depth sustainability on its belief that education is the first stage of human capital development for the nation, which led to our establishment of the Vidyasirimedhi Institute, a tertiary education institution specializing in research for sustainable development, and the Kamnoetwit Science Academy, a high school focusing on science and mathematics preparing talented students to become future scientists.

PTT Group firmly believes in tax transparency and good tax governance to uphold our sustainable growth for all stakeholders. We are committed to maintaining and improving our tax reporting and transparency procedures.