| Sustainable Development Goals |

Positive and Negative Impacts

Impact of Issues over Time

Short Term |

Medium Term |

Long Term |

High |

High |

High |

Climate Change Management |

Financial Materiality |

Impact Materiality |

|

|

Risks | Opportunities | + Job creation driving the transition to a low-carbon society + Mitigating of environmental impacts and improvements in society’s quality of life - Deteriorating ecosystems, loss of biodiversity - Decline in quality of life for populations, including health challenges, food and water insecurity, displacement, etc. |

| - Increased operational costs due to disruptions in business operations and supply chains interruptions, damage to infrastructure, regulatory pressures, and legal challenges, etc. | + Cost savings through enhanced energy efficiency + Strengthened reputation and trust among stakeholders + New market access and expansion to untapped consumer segments + Opportunities for innovation that create new revenue streams |

||

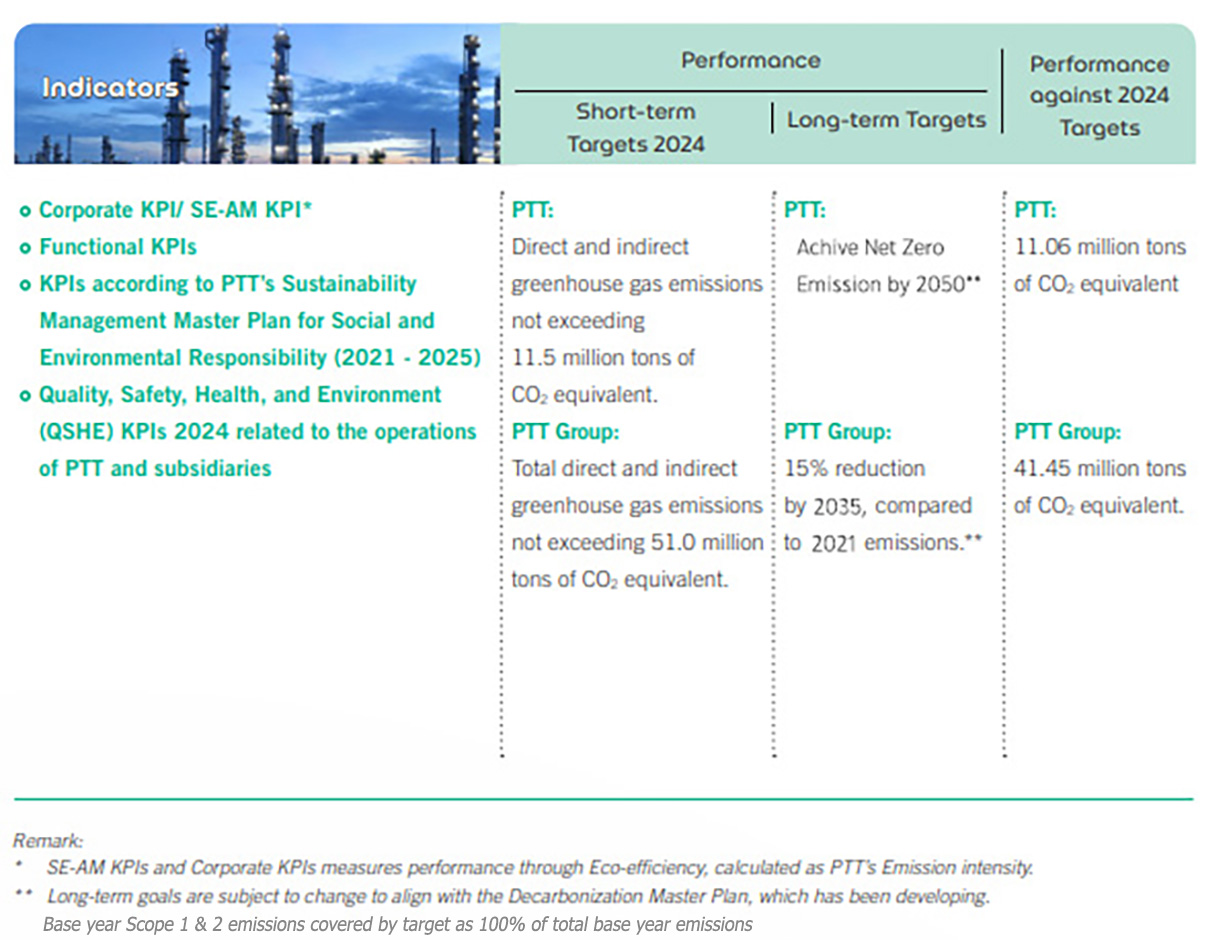

Objectives/ Targets

|

Management Approaches

PTT Climate Change Statement

Integrating risks and opportunities from climate change into business operations

In setting the organization’s strategic direction for 2024, PTT has fully integrated the financial impacts, along with the risks and opportunities posed by climate change, into its strategic goals and sustainability management framework to ensure alignment with the Company’s vision. As part of commitment to achieving carbon neutrality by 2040 and net zero emissions by 2050. Under the PTT Sustainability Management Framework, the Company emphasizes managing its investment portfolio while also reducing greenhouse gas emissions in accordance with its goals. To achieve this, PTT has introduced the “C3 Approaches”, which includes: C1 - Climate-Resilient Business, C2 - Carbon-Conscious Assets, C3 - Coalition, Co-Creation, and Collective Efforts for All.

- These strategic approaches are embedded in the Company's business plans and action plans across all business units, departments, support functions, and the entire PTT Group.

- The Company has set key performance indicators (SE-AM KPIs/Corporate KPIs) at both the organizational and business unit levels to ensure consistent implementation and alignment throughout the organization.

- PTT’s Corporate Risk Profile, with a thorough risk management plan in place.

PTT closely monitors and provides updates on the progress of its operations in line with business plans and goals at the business unit level. It also prepares a comprehensive report for the entire Company, which is presented to the Board following the established governance structure at both the management and Board levels. This process ensures regular reviews, offers recommendations, and drives performance on a quarterly basis.

Organizational restructuring to support strategic direction and sustainability management framework

To further strengthen its sustainability efforts, PTT has restructured its organization to establish the position of Deputy CEO for Corporate Sustainability. The Company has also formed committees and task forces to create a master plan and action plan for reducing greenhouse gas emissions across the PTT Group. This ensures that the operations of PTT Group align with the defined sustainability objectives and targets.

Organizational Structure Diagram

PTT has integrated its approach to climate change into the organization's strategic direction, business plans, and risk management processes. This oversight is provided across multiple dimensions, both in overall sustainability and within various relevant systems, as outlined below:

- Governance of climate change issues is a key component of sustainability. At the management level, this falls under the responsibility of the Governance Risk Compliance and Sustainability Management Committee (GRCMC), which reports quarterly to the Corporate Governance and Sustainability Committee (CGSC). The PTT Group Sustainability Strategy and Management Committee (GSMC) ensures the operational framework and alignment across the PTT Group.

- Governance of greenhouse gas (GHG) emissions reduction, in line with long-term goals and the net-zero emissions target, is managed by the PTT Group Net Zero Task Force (G-NET). This task force establishes clear targets to address climate change, supporting Thailand's carbon neutrality goal and the Ministry of Energy's net-zero emissions policy. It also drives business model transformations in accordance with the defined strategic direction and business plans.

- Enterprise risk management governance includes addressing the challenges posed by climate change risks, which are considered among the organization's top-level risks. To mitigate these risks, measures must be put in place to reduce the likelihood of occurrence (Control) and minimize impacts (Mitigation Plan), along with monitoring key risk indicators (Leading/Lagging Key Risk Indicators). Progress is reported quarterly to the Corporate Plan and Risk Management Committee (CPRC) at the management level and the Enterprise Risk Management Committee (ERMC) at the board level.

The Executive Vice President of Sustainability Strategy and Management is the primary unit responsible for overseeing and coordinating the development of policies, goals, strategies, performance indicators, management approaches, and action plans. This is carried out in collaboration with various departments across the corporate level, business groups, business units, and relevant functions within the organization, including the PTT Innovation Institute, the New Business and Infrastructure Group, and the Natural Gas Business Unit, among others.

Climate Change Management ProcessGRI201-2

PTT's approach to managing climate change is fully aligned with sustainable development principles and adheres to international standards. The process includes the following key steps:

- Collection of greenhouse gas emissions data and related information on risk and opportunity management regarding climate change, as detailed in the PTT Group's greenhouse gas emissions accounting standards and tools.

- Monitoring global and local climate change developments that affect the organization’s business operations, including laws, regulations, and policies (e.g., the Climate Change Bill, carbon pricing regulations, or other laws impacting PTT), greenhouse gas control mechanisms, and international climate change guidelines and standards. This also involves participation in meetings, public consultations, and actions by government agencies, public organizations, and other stakeholders.

- Identifying enterprise-level risks and opportunities related to climate change, including:

- Risks associated with transitioning towards a low-carbon society (Transition Risks).

- Risks stemming from the physical changes in climate (Physical Risks).

- Opportunities arising from climate change.

- Incorporating risks and opportunities into business scenario analysis during the strategic planning process, and assessing related financial impacts through financial forecasting and planning. This process relies on data from monitoring global and local climate change developments affecting the organization’s operations, along with the identification of risks and opportunities. It includes:

- Mitigation Actions: Efforts to control, reduce, or capture greenhouse gas emissions to minimize climate change impacts.

- Adaptation Actions: Measures taken to adapt to changing climate conditions to ensure sustainable business competitiveness.

- Integrating into the organization's business plan, including the creation of a Corporate Risk Profile in the enterprise risk management process. This involves gathering all risk factors from business groups, business units, support functions at the corporate headquarters, and external factors that could severely impact the organization. These risks are then set as performance indicators at the corporate level (via the SE-AM KPI system) and further broken down into functional KPIs for relevant departments.

- Monitoring and reviewing progress on business plan execution, strategies, and KPIs, with quarterly reporting to the board, following the governance structure at both the management and PTT Board levels.

- Summarizing performance results and transparently disclosing them to internal and external stakeholders through the 56-1 One Report and the PTT’s website.

Risk Management

|

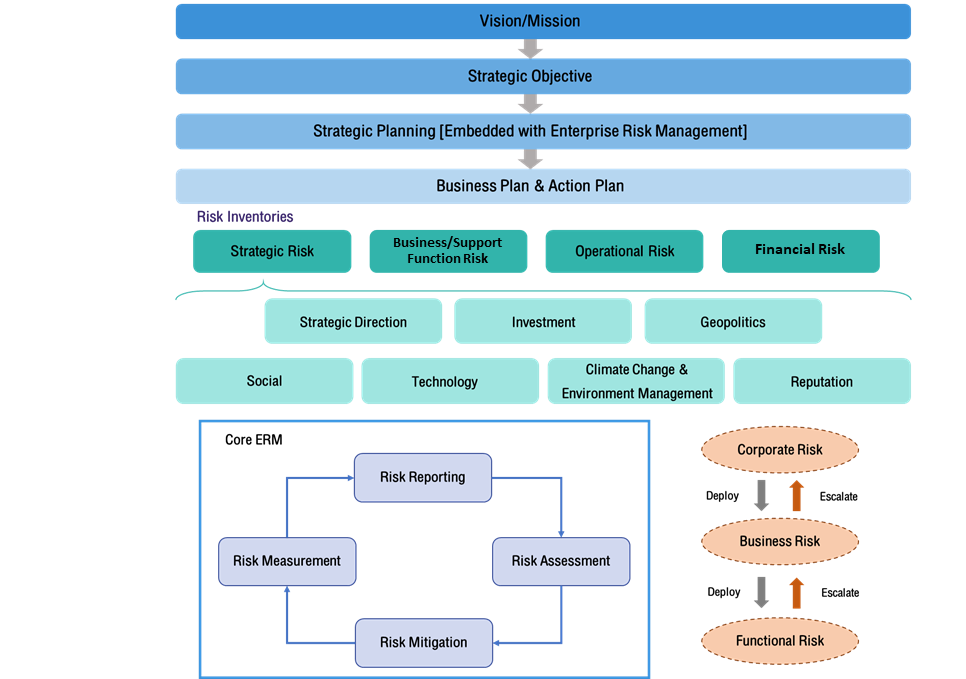

PTT has established a comprehensive enterprise-wide risk management system, designed to align with international standards such as COSO ERM 2017 and ISO 31000:2018, both widely recognized and accepted by leading global organizations. This risk management process is integral to ensuring that the organization achieves its vision, mission, and strategic goals. It is directly linked to strategic planning and the development of the business plan, helping to mitigate risks that may hinder the achievement of these objectives.

During the strategic planning phase, it is crucial to identify risk factors at the organizational level, across business groups, support functions, and operational units. This process should take into account both internal and external factors, as well as the organization’s key goals, strategies, and stakeholders' expectations. This ensures that all potential risks—both short-term and long-term are comprehensively identified.

As part of the business planning process, PTT will compile a Corporate Risk Profile, which involves gathering risk factors from all parts of the organization, including business groups, units, support functions, and external sources that could have significant impacts on the organization. This process aims to minimize negative impacts and reduce the likelihood of risks, while also identifying opportunities to create value. A risk management plan is then developed, which includes Key Risk Indicators (KRIs) and assigns responsibility to risk owners for effective risk management.

Once the Corporate Risk Profile and risk management plan have been reviewed and refined by the Enterprise Risk Management Committee, they will be integrated into the business plan for approval by the PTT Board. This ensures alignment with the organization's strategic goals and objectives. The risk management plan will then be communicated from the Enterprise Risk Management Committee to the management team and operational units for implementation throughout the organization. This enables the organization to proactively address risks in a timely manner and remain well-prepared to manage risks across all areas of the business.

Climate Risk and Opportunity AssessmentGRI201-2

PTT has integrated the assessment of risks and opportunities related to climate change into its strategic planning and enterprise risk management processes. This includes employing Climate Scenario Analysis based on the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) to evaluate and understand both physical risks and transition risks. These risks, stemming from climate change, are assessed for their potential impacts on business operations over various time horizons. The evaluation process covers the sectors of upstream petroleum, natural gas, downstream petroleum, and new business ventures related to sustainability and infrastructure. Additionally, PTT adheres to the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards (S2), which are aligned with TCFD, to disclose opportunities and risks related to climate change. For further details, you can visit the PTT’s website under the Sustainability section. There, you will find the Climate Change Management subsection, where you can download the full risk assessment report for more in-depth information.

PTT Task Force on Climate-related Financial Disclosures (TCFD) Report 2024

Transition Risk: Risks from the Shift to a Low-Carbon Society

- Policy and Legal: National greenhouse gas reduction targets and policies, the Climate Change Bill linked to carbon tax implementation, and the carbon trading system. These risks encompass government policies, strategic goals, and regulations set by public authorities in Thailand overseeing environmental issues.

- Market: Price volatility and demand fluctuations in various business scenarios, alongside shifting consumer behavior, such as the declining demand for fossil fuels.

- Technology: Emerging technologies supporting the transition to a low-carbon economy, such as electric vehicles and high-performance batteries. This also includes disruptions from the replacement of old technologies with innovative, greener alternatives.

- Reputation: Investor expectations and demands for effective climate change management and the transition to low-carbon business operations.

PTT has conducted a climate change risk assessment, considering two distinct climate scenarios: Clean Scenario and Clear Scenario. The Clean Scenario follows the International Energy Agency (IEA) Stated Policies Scenario (STEPS), which projects a global temperature increase of up to 2.5°C by 2100. In contrast, the Clear Scenario is based on the IEA Announced Pledges Scenario (APS), which anticipates a global temperature rise of 1.7°C by 2100, aligning with the goals of the Paris Agreement. The risk assessment covers both the medium-term period (until 2030) and the long-term period (until 2050). A critical high-risk factor identified is the potential implementation of carbon taxes by the government, which could significantly affect the organization. These risks must be incorporated into the business planning process to inform the development of future strategies and business plans.

- Risks stemming from sudden natural disasters (Acute), such as catastrophic natural occurrences.

- Gradual, ongoing changes in the climate over an extended period (Chronic), such as rising temperatures and increasing sea levels.

To better align strategies with potential future climate events, PTT has mapped the geographical locations of its operations and key business partners, including those in both upstream and downstream sectors, which face physical climate risks. The company has conducted a Scenario Analysis for each operational area, referencing greenhouse gas emission pathways from the Shared Socioeconomic Pathways (SSPs) published by the Intergovernmental Panel on Climate Change (IPCC) in its Assessment Report 6. This risk assessment spans the medium-term, until 2030, and long-term, until 2050, identifying key risks, such as extreme heat and water stress/drought, that could impact operations. Each business unit is responsible for preparing and implementing appropriate mitigation strategies to reduce and respond to these risks. PTT has established a business continuity management system and conducts quarterly reviews to ensure ongoing preparedness. Furthermore, adaptation goals addressing physical risks will be defined for both existing and new operations, with measures set to be implemented within a 5-10 year timeframe.

Opportunities:- Innovations that enhance energy efficiency.

- Opportunities for expanding into renewable and alternative energy sectors.

- Expanding into markets that prioritize clean, sustainable, and environmentally friendly energy products.

- Access to funding sources, both domestically and internationally.

- Increasing income from low-carbon products—meaning those (products or services) offered by the PTT Group, which produce fewer greenhouse gas emissions, including renewable energy sources like solar, water, and RDF (Refuse-Derived Fuel).

- Avoiding carbon emissions—meaning products (products or services) of the PTT Group that help customers reduce greenhouse gas emissions, such as biofuels like E10, E20, E85, biodiesel, and natural gas.

C3 Approaches

C1 - Climate-Resilience Business

Investing in clean energy, low-carbon business, and restructuring the business by adjusting the portfolio to align with global and Thailand’s energy transition directions.

Key Initiatives

- The hydrocarbon business prioritizes natural gas and LNG. Investments are made in infrastructure while driving growth through investments in the LNG value chain.

- Complete exit from the coal business.

- Continually expanding investments in renewable energy, both in Thailand and abroad.

- Focusing on exploring and producing natural gas, expanding investments in Clean Hydrogen production, along with renewable energy project.

- Redirecting investments towards low-carbon businesses.

C2 - Carbon Conscious Asset

Focusing on reducing greenhouse gas emissions from production processes and operational activities through various methods.

Key Initiatives

- Enhancing energy conservation and energy efficiency

- Utilizing clean and renewable energy

- Adopting advanced technologies such as Small Modular Reactors (SMR), etc.

C3 - Coalition, Co-creation, and Collective Efforts for All

Collaborating with stakeholders as national leader in developing infrastructure and technologies to reduce greenhouse gas emissions such as Carbon Capture and Storage (CCS), hydrogen

utilization, and reforestation in collaboration with various organizations to absorb carbon dioxide through nature-based solutions.

Key Initiatives

- CCS Project at the Arthit/ Eastern Thailand CCS Hub

- Expanding forest of an additional 2 million rai (3.2 billion square meters).

Budget and Resource Allocation

From 2024 to 2028, PTT Group has allocated a 5-year investment plan with a total budget of approximately THB 1.094 trillion. This plan is designed to ensure energy security, maintain competitiveness, and drive business growth for the Group. It also aims to capitalize on emerging opportunities in new energy sectors, particularly those related to Carbon Capture and Storage (CCS) and hydrogen. The Group plans to accelerate investments in infrastructure to support carbon capture across its production processes and those of its subsidiaries. Furthermore, it is committed to achieving balanced, long-term growth while pursuing its goal of Net Zero Emissions, in alignment with the global energy sector’s evolving trends. By 2024, a total of THB 281.582 billion has already been invested

Key Plans and Initiatives

Performance in Line with C3 Approaches

C1 - Climate-Resilience Business

Natural Gas and LNG

The hydrocarbon business is prioritizing natural gas and LNG as clean energy sources during the energy transition. Natural gas is sourced from both domestic and international locations, while LNG imports are tailored to meet Thailand’s energy demands. Strategic investments are being made in infrastructure and growth opportunities through LNG Value Chain. Long-term LNG purchase agreements are secured for 6.2 million tons.

Exit from Coal Investments

PTT has fully exited the coal sector, completed in 2023.

Renewable Energy

PTT continues to expand its investments in renewable energy through GPSC, both domestically and internationally. This includes the provision of stable and clean electricity to PTT Group, significantly contributing to the reduction of Scope 2 greenhouse gas emissions. In 2024, the renewable energy capacity reached from 4.9 GW. to 9.9 GW.

Exploration and Production of Petroleum

PTT Exploration and Production Public Company Limited (PTTEP) is focusing on natural gas exploration and production, while also expanding investments in Clean Hydrogen production in Oman. Additionally, PTTEP is further advancing renewable energy projects, such as offshore wind farms.

Low-Carbon Business

PTT is increasingly shifting its investments towards low-carbon sectors. Notably, OR is emphasizing mobility and lifestyle, with a growing focus on EV Charger infrastructure. Moreover, PTT is diversifying into high-value chemicals and environmentally sustainable bio-based and circular economy businesses through GC.

New Product from Carbon Capture and Utilization (CCU) Technology

PTT is exploring the development of technologies or projects that capture carbon dioxide emissions from its natural gas separation plants, and use as raw material to convert to new product such as methanol, a critical feedstock for the chemical industry and fuel production, which Thailand currently imports in large quantities. Another key product under consideration is calcium carbonate, which is increasingly in demand across Southeast Asia for use in plastics, adhesives, and synthetic rubber. These projects are in the feasibility study phase, with future potential for expansion and partnerships that will help create new business opportunities while enhancing Thailand’s global competitiveness.Group-Level Water Risk Adpatation under PTT Group

PTT group has implemented a unified water risk adaptation strategy. Given demonstration of GC that deploys 3Rs principle-based initiatives – Reduce, Reuse and Recycle. These include;

Process optimization: GC has installed Mobile Sea Water Reverse Osmosis (SWRO) units at the refinery and retrofitted pipeline systems to recycle wastewater, along with Wastewater Reverse Osmosis (WWRO).

Water supply resilience: GC has secured resource contracts at higher operational costs (an estimated OPEX increase of approximately 8 million THB per year) to reinforce water supply security.

Collaboration: Under the PTT group, GC actively collaborates with stakeholders including the PTT flagship companies through the Water War Room in Rayong, engages with the Map Ta Phut Plant Manager Club, and partners with local communities to conserve watershed areas. In addition, strategic collaboration with the Eastern Economic Corridor (EEC) also supports the feasibility study of a large-scale SWRO plant with a daily capacity of 200,000 liters, potentially attracting external investment.

C2 – Carbon-Conscious Asset

Enhancing Production Processes and Energy Efficiency Initiatives

PTT is investing in the construction of Natural Gas Separation Plant Unit 7, which will replace Unit 1, with a budget of over THB 18 billion. The plant is expected to begin commercial operations in 2025. The new facility will feature an optimized cooling system that improves production efficiency while reducing operational risks. By utilizing the cooling effect of liquefied natural gas (LNG), this upgrade will reduce greenhouse gas emissions by 112,000 tons of carbon dioxide equivalent per annum, compared to Unit 1. In 2024, the Rayong Gas Separation Plant will also implement a project to install Regenerative Thermal Oxidizers (RTO) at Units 5, 6, and Ethane Separation Plant (ESP). This initiative is projected to reduce greenhouse gas emissions by approximately 190,000 tons of carbon dioxide equivalent per annum.Renewable Energy Integration in Operational Areas

In 2024, PTT installed solar panels at the Khao Bo Ya LPG Terminal and Sriracha Oil Terminal, replacing grid electricity with 100 kW of floating solar capacity. This project is expected to decrease greenhouse gas emissions by around 63 tons of carbon dioxide equivalent per annum.

Energy Management Initiatives

PTT has rolled out an energy management plan across the organization, prioritizing sites with significant energy consumption, including the Rayong and Khanom natural gas separation plants, both of which are ISO 50001:2018 certified. The company sets annual energy reduction targets and implements energy conservation projects, training programs, internal audits, and energy reviews to identify hot spots and areas for improvement in energy efficiency.

In 2024, PTT provided training for employees to help them understand the company's impact on the environment and to raise awareness among personnel about optimizing energy usage. This initiative aims to foster a culture focused on reducing energy consumption and enhancing understanding of the benefits of waste reduction across operations and to help educate and engage employees regarding water efficiency management and conservation. The courses, such as QSHE Awareness for Employees, had a total of 564 participants and QSHE Awareness for Contractors, had a total of 499 participants from various departments.

Additionally, other operational sites such as the Gas Pipeline Operations Center, NGV stations, Eastern Petroleum Depots, Innovation Institute, and headquarters are subject to the Energy Conservation Promotion Act. These sites must comply with the law, undergo annual external energy audits, and report to the Ministry of Energy.

Energy Conservation Activities and Innovations

PTT actively promotes and implements the Productivity Improvement Circle (PIC) program every year, encouraging employees to submit projects aimed at improving work processes. The company collaborates with the PTT Innovation Institute to develop cutting-edge innovations and implement process improvements focused on reducing electricity consumption, as well as advancing energy conservation and clean energy initiatives that lead to both cost savings and improved efficiency. Notable examples of PIC projects that have earned recognition (PIC Award) include fuel reduction for gas compressors at the Wangnoi Compressor Station (WCS), the QC Group’s Hydrocarbon Loss Reduction at the Refrigeration System (M3), and the Tail Gas Loss Reduction to Flare project at the Benfield Unit GSP.1.

In 2024, PTT's operational areas, such as the gas pipeline system, launched several projects to enhance energy efficiency. These initiatives have contributed to an estimated annual energy reduction of 7,100 MMBTU, translating to a reduction of approximately 420 tons of carbon dioxide emissions each year. Additionally, PTT is investing around 18 billion baht in the construction of the Natural Gas Separation Plant Unit 7, which will replace the 1st unit. This new plant is scheduled to begin commercial operations (COD) in 2026. The plant will incorporate an advanced refrigeration system designed to improve efficiency, mitigate operational risks, and harness the cooling capacity of liquefied natural gas, resulting in a significant reduction of 112,000 tons of CO2-equivalent greenhouse gas emissions annually compared to the 1st unit.

Furthermore, PTT emphasizes energy awareness through training programs and internal campaigns for employees. This includes efforts to promote electricity conservation in office environments and provide employees with knowledge.

PTT Energy Management Report 2024

Energy Usage

Total energy consumption |

Unit |

2021 |

2022 |

2023 |

2024 |

| Total non-renewable energy consumption | MWh | 137,893,025 | 137,989,295 | 121,551,868 | 122,238,123 |

| Total renewable energy consumption | MWh | 15,261 | 33,123 | 62,237 | 108,012 |

PTT group determined to reduce the non-renewable energy consumption compared to last year by targeting the total non-renewable energy consumption below 123,000,000 MWh

C3 - Coalition, Co-creation, and Collective Efforts for All

Carbon Capture and Storage (CCS) Project

PTT is advancing its efforts to capture and store carbon dioxide (CO2) from production processes in the Gulf of Thailand, while exploring the potential for carbon dioxide storage in nearshore areas along the eastern coast. This initiative forms part of a broader collaborative effort within PTT Group to develop PTT Group CCS Hub Model. Below are the latest updates on the project’s progress:

- Offshore: PTT Group actively working on a CCS project at the Arthit Gas Field in the Gulf of Thailand. After completing the Front-End Engineering Design (FEED) phase, the project is now in the process of negotiating agreements ahead of the Final Investment Decision (FID), which is anticipated for early 2025. Following the FID, the project will take approximately three more years to fully develop before initiating carbon injection operations. Once operational, the offshore CCS project will have the capacity to store approximately 0.7 to 1 million tons of carbon dioxide equivalent per annum.

- Nearshore: PTT Group’s nearshore CCS project along Thailand’s Eastern Seaboard is designed to capture and store between 6 to 10 million tons of carbon dioxide per annum. This project is slated to begin in 2034. As part of its planning process, the Group has completed a comprehensive study on CCS in the region, titled The Eastern Thailand Carbon Capture and Storage Hub: CCS Hub (White Paper). This report has been submitted to the government through the Climate Change Subcommittee on Greenhouse Gas Emissions Reduction Technologies under the National Climate Change Policy Committee. Additionally, the Group has conducted detailed studies on carbon dioxide capture costs, the feasibility of carbon dioxide gathering and transportation, and various business models for CCS, all of which will guide future investment decisions. In 2024, PTT will partner with government agencies to incorporate CCS-related technologies and research into the National Energy Plan (NEP)

Furthermore, PTT Group has become a member of the Thailand Carbon Capture, Utilization, and Storage (CCUS) Alliance (TCCA), partnering with leading academic institutions, private companies, government agencies, and public organizations. The aim is to build a robust collaborative platform to drive the development and implementation of CCUS technologies across all dimensions. This collaboration will help push forward CCS projects and contribute to the country’s goal of reducing greenhouse gas emissions.

Hydrogen Fuel Energy Projects

The use of hydrogen gas as a fuel source in the industrial sector, or in fuel cells through an electrochemical process to generate electricity, offers the significant advantage of being a clean energy source that produces no pollution. In 2019, PTT initiated the establishment of the Hydrogen Thailand Club (now known as the Hydrogen Thailand Association) to drive the adoption of hydrogen technology as a new alternative energy for Thailand’s future.

PTT has strategically identified hydrogen as a key initiative to reduce greenhouse gas emissions and to align with the government’s policies outlined in the draft PDP 2024, which includes plans to blend hydrogen with natural gas at a 5% ratio in the power generation sector by 2030. To support this, PTT is preparing the necessary infrastructure and implementing initiatives throughout PTT Group’s supply chain. In addition, PTT has partnered with PTT Oil and Retail Business Public Company Limited (OR), Bangkok Industrial Gas Co., Ltd. (BIG), Toyota Daihatsu Engineering and Manufacturing Co., Ltd. (TDEM), and Toyota Motor Thailand Co., Ltd. (TMT) to conduct tests on hydrogen fuel use for fuel cell electric vehicles. This testing took place at Thailand’s first hydrogen refueling station in Bang Lamung District, Chonburi Province, using Toyota’s Mirai model. The project has been successfully completed.

In 2024, PTT, in collaboration with the Hydrogen Thailand Club, submitted nine hydrogen pilot projects to the government. These projects, which span both hydrogen production and utilization in the energy sector, have now been included in the national energy action plans, projects, and key activities.

Collaboration with the Government to Expand Green Spaces

As part of the “Permanent Forest Planting Project in Honor of His Majesty King Bhumibol Adulyadej the Great’s 50th Anniversary of His Accession to the throne,” PTT has been actively involved in planting and rehabilitating degraded forest areas since 1994. The project has successfully covered 1 million rai across all regions of Thailand. In addition, PTT has built a strong conservation network, including forest protection volunteers and partnerships with environmental organizations to ensure the sustainability of forest preservation efforts, such as conserving soil, water, and forests. Looking ahead to 2024 and beyond, PTT remains committed to expanding green areas for natural greenhouse gas absorption. The company has set a goal to plant an additional 1 million rai of forests – both terrestrial and mangrove – by 2030. Along with this, PTT will continue to monitor and maintain these areas while tracking the carbon dioxide absorption performance across regions.

In 2024, PTT has received support for land and successfully carried out reforestation efforts covering over 62,696.3 rai across 17 provinces. This is alongside the registration of reforestation plots under Thailand’s Voluntary Greenhouse Gas Reduction Program (T-VER). The program aims to enhance the standard of forest restoration based on scientific principles and includes carbon credit certification (T-VER) for 8 projects completed in 2023, covering a total area of 84,791.70 rai.

PTT works closely with local communities by encouraging the establishment of community enterprises to oversee planting and maintenance, as well as providing education to foster local involvement in forest and environmental conservation. This approach helps build social capital and enhances the economic value of the communities, enabling them to live sustainably with the forests.

Moreover, PTT has partnered with AI and Robotics Ventures (ARV), a subsidiary of PTTEP, and Varuna (Thailand) Co., Ltd., to apply innovative technologies for assessing carbon dioxide absorption in forests through remote sensing. This initiative aims to optimize the management of forest data.

Collaboration with the Government and Various Networks

PTT, in partnership with the Ministry of Natural Resources and Environment, the Department of Climate Change and Environment (DCCE), and the Thailand Greenhouse Gas Management Organization (Public Organization) (TGO), organized the Thailand Climate Action Conference (TCAC) 2024. This annual conference serves as a platform to unite all sectors and levels of society in advancing climate action, with the goal of achieving Thailand’s Nationally Determined Contributions (NDC) by 2030. Additionally, PTT actively participates in the 3rd Climate Action Leader Forum, hosted by TGO and DCCE, to engage with leaders from all sectors in discussions about ideas, experiences, and strategies for addressing climate change and driving sustainable development. At the 29th Conference of the Parties (COP29) to the United Nations Framework Convention on Climate Change (UNFCCC), held from 16 - 22 November 2024, in Baku, Azerbaijan, PTT contributed to the Thailand Pavilion by presenting a special exhibition and side events under the theme “Sustainable Growth: Key to Thailand’s Net Zero Success.” This opportunity allowed PTT to exchange insights and collaborate with DCCE and TGO on the global stage.

As the Chair of the Thailand Climate Neutral Network (TCNN), established by TGO, PTT works alongside over 700 organizations from across public and private sectors, academic institutions, international organizations, foundations, and non-profits. Through three specialized subcommittees – focused on climate change policy, carbon markets, and implementation and engagement – PTT leads efforts to enhance greenhouse gas reduction, promote sustainable growth, and build a climate-friendly society. PTT has formulated a comprehensive plan to drive policy initiatives aimed at raising greenhouse gas reduction standards to global levels. The company is committed to becoming “Thailand’s leading network for achieving Carbon Neutrality and Net Zero Emissions.” As part of this ambition, PTT has joined the United Nations Framework Convention on Climate Change’s (UNFCCC) Climate Neutral Now program, and actively participates as both a “Climate Action Innovator” and a “Climate Action Leading Organization” (CALO). In 2024, PTT was honored as one of only 23 organizations in Thailand to receive the prestigious CALO award for exceptional leadership in greenhouse gas management. This recognition was based on PTT’s outstanding performance in emissions measurement and reduction, achieving a Gold level rating (from 125 CALO-certified organizations). Furthermore, PTT works closely with the DCCE to present policy recommendations to the government, driving the country’s efforts towards carbon neutrality and contributing to the overall climate action strategy.

Development and Application of Tools and Mechanisms for Greenhouse Gas Management

Utilizing Internal Carbon Pricing in PTT's Investment Decision-Making

The internal carbon pricing mechanism is a key tool used by PTT to assess and make investment decisions in projects that contribute to reducing greenhouse gas emissions and mitigating the effects of climate change. It also aligns with PTT’s commitment to fostering a low-carbon society. These investment decisions are carefully considered by PTT’s Investment Management Committee and the PTT Management Committee. PTT applies a shadow price model for carbon pricing, set at USD 20 per ton of CO2 equivalent. This pricing mechanism is applied across all greenhouse gas emissions-related projects and initiatives that require approval from the Strategic Investment Management Committee (SIMC). It serves as one of the key drivers in advancing the company’s Greenhouse Gas reduction efforts and plays a supporting role in achieving the organization’s overall Greenhouse Gas reduction targets. Examples of such projects include the use of renewable energy in operations and the selection of initiatives related to carbon capture and utilization. Furthermore, PTT actively promotes and supports its group companies in adopting the internal carbon pricing principle when evaluating and selecting projects. This approach helps ensure that all PTT Group companies prioritize projects that contribute to greenhouse gas reduction, in line with the group’s overall emission reduction targets. In addition, PTT applies internal carbon pricing as part of its internal framework for assessing climate-related risks and opportunities, enabling more robust strategic planning, and ensuring preparedness for a low-carbon transition

Carbon Footprint for Organization (CFO) Reporting

In 2023 and 2024, PTT has compiled data on greenhouse gas emissions and sequestration resulting from its organizational activities, following the Thailand Greenhouse Gas Management Organization (Public Organization) guidelines. This includes both direct and indirect emissions. Meanwhile, the amount of greenhouse gas sequestered through PTT's reforestation initiatives under the Permanent Forest Planting Project in Commemoration of His Majesty King Bhumibol Adulyadej the Great’s 50th Anniversary of His Accession to the Throne (initiated in 1994).

Net Zero Pathway Certification

PTT has taken part as a pioneer organization and applied for certification under the Net Zero Pathway initiative with the Thailand Greenhouse Gas Management Organization (TGO). This process follows the established guidelines for certifying Net Zero Greenhouse Gas Emissions, ensuring that PTT's net zero targets and greenhouse gas reduction strategies are in line with international standards and comply with Thailand's regulatory framework. PTT successfully received the Net Zero Pathway certification from TGO on November 27, 2024.

Enhancement of Greenhouse Gas Accounting and Reporting

PTT systematically prepares accounting and reports on the emissions, absorption, and storage of greenhouse gases. This encompasses direct emissions (Scope 1), indirect emissions from energy consumption (Scope 2), other indirect emissions (Scope 3), and the sequestration of greenhouse gases through PTT’s reforestation efforts. In 2024, PTT updated its greenhouse gas accounting and reporting guidelines to include the calculation methods for significant Scope 3 emissions. This includes emissions from the combustion of fuel sold by PTT, waste disposal from production processes, disposal of products sold by PTT, and business-related travel. Additionally, PTT has evaluated strategies for setting emissions reduction targets for significant Scope 3 activities that hold potential for emissions reductions. Notably, this includes reducing emissions from waste disposal in production processes, with a goal of decreasing emissions by 5% by 2030 from the 2020 baseline. This initiative also aligns with PTT's commitment to advancing the circular economy.

Moreover, PTT has developed calculation tools in line with international standards such as those set by the Intergovernmental Panel on Climate Change (IPCC) and Thailand's national standards, including those from the Greenhouse Gas Management Organization (Public Organization), to ensure accurate reporting of greenhouse gas absorption. These revisions to the guidelines ensure that all PTT Group companies follow a unified and consistent approach to greenhouse gas accounting and reporting.

Future Plans

To drive the sustainability strategy of the PTT Group and achieve its established goals, the Group has formed a PTT Group Decarbonization Masterplan and Execution Roadmap Steering Committee (G-Decarbon) as well as a PTT Group Decarbonization Masterplan and Execution Roadmap Working Team (G-Decarbon Working Team). This committee is tasked with conducting studies and developing the PTT Group Decarbonization Masterplan and Execution Roadmap that covers operations from upstream to downstream within the PTT Group. A clear and unified approach is expected to be finalized by the second quarter of 2025, with further targets for significant Scope 3 emissions to be set accordingly.

In addition, PTT is conducting studies and compiling data on decarbonization across its entire value chain, from upstream to downstream, in order to manage the full supply chain and track performance based on the monitoring framework for other indirect greenhouse gas emissions (Scope 3), particularly from waste disposal in the production process. In addition, PTT will track the progress of the draft Thailand Power Development Plan for 2024-2037 and the draft Natural Gas Management Plan for 2024-2037. These will guide the establishment of appropriate approaches for setting targets for indirect greenhouse gas emissions (Scope 3) from fuel combustion activities related to PTT’s product sales, measured in intensity.

The Carbon Capture and Storage (CCS) project is also a critical part of the PTT Group’s strategy to reduce greenhouse gas emissions. PTT plans to sign a Memorandum of Understanding (MoU) related to the CCS Hub project to collaboratively study and develop a suitable Integrated Business Model for the CCS Hub. This initiative also involves examining the relevant regulations for the CCS Hub and pushing for the development and improvement of regulations to encompass CCS activities across the entire value chain.

Looking ahead, PTT is focused on enhancing production efficiency. Pollution control units for VOCs and H2S compounds will be installed at the Ethane Separation Plant (ESP) and the Natural Gas Separation Plant Unit 6, both of which are expected to begin operations in 2025. These efforts are anticipated to reduce greenhouse gas emissions by approximately 200,000 tons of CO2 equivalent per year. Additionally, PTT plans to study improved methods for calculating methane leakage from natural gas pipeline transportation activities to better manage methane emissions. This initiative is expected to reduce greenhouse gas emissions by approximately 120,000 tons of CO2 equivalent annually.

Sustainability Performance of PTT: Environmental